Last Updated on December 26, 2025

Singapore New Launch Property Outlook 2026 — Mega Guide

2026 is shaping up to be one of the most important launch years of the decade — not because there are “many projects”, but because of how supply, demand and buyer behaviour are aligning after a record-setting 2025. Interest rates have eased back towards post-COVID lows, developers are still bidding confidently for GLS land, and Singapore continues to prove itself as a safe haven for both local and overseas capital.

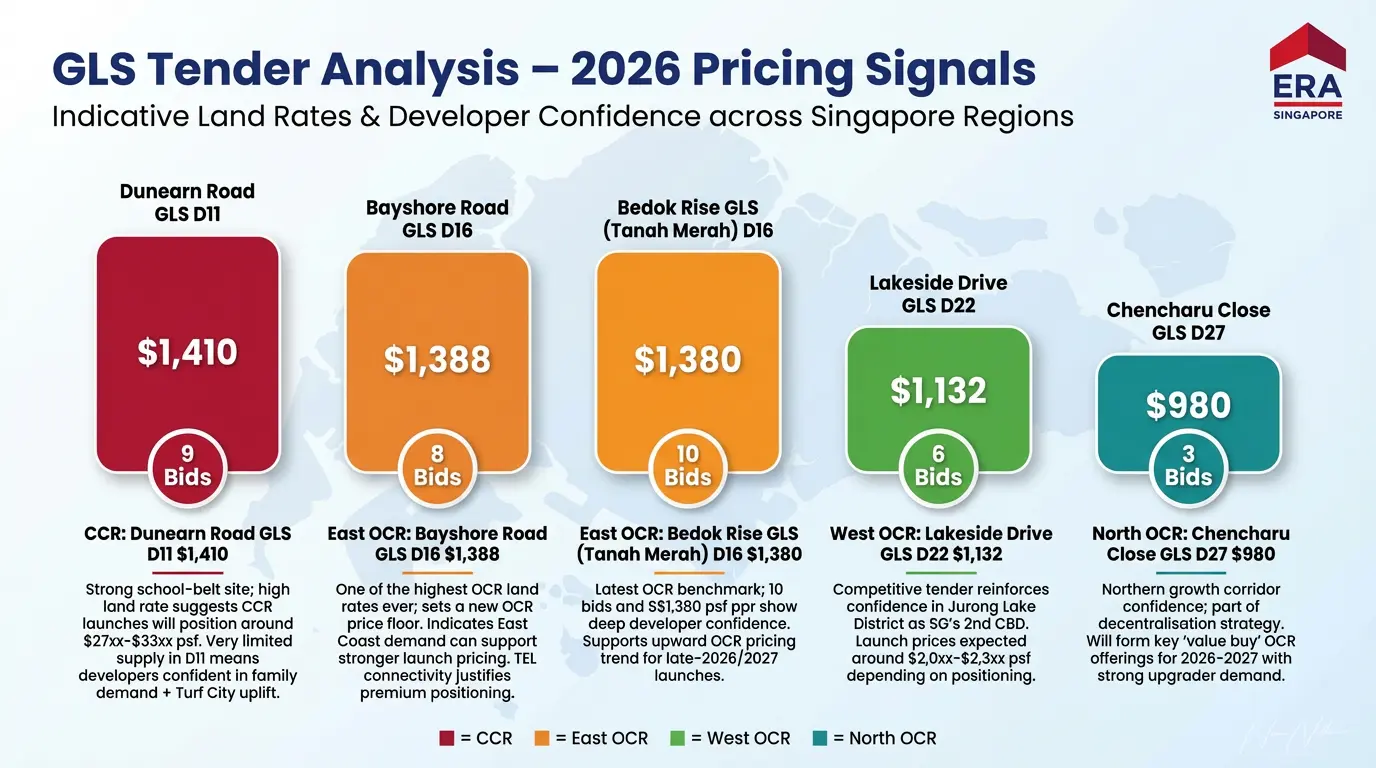

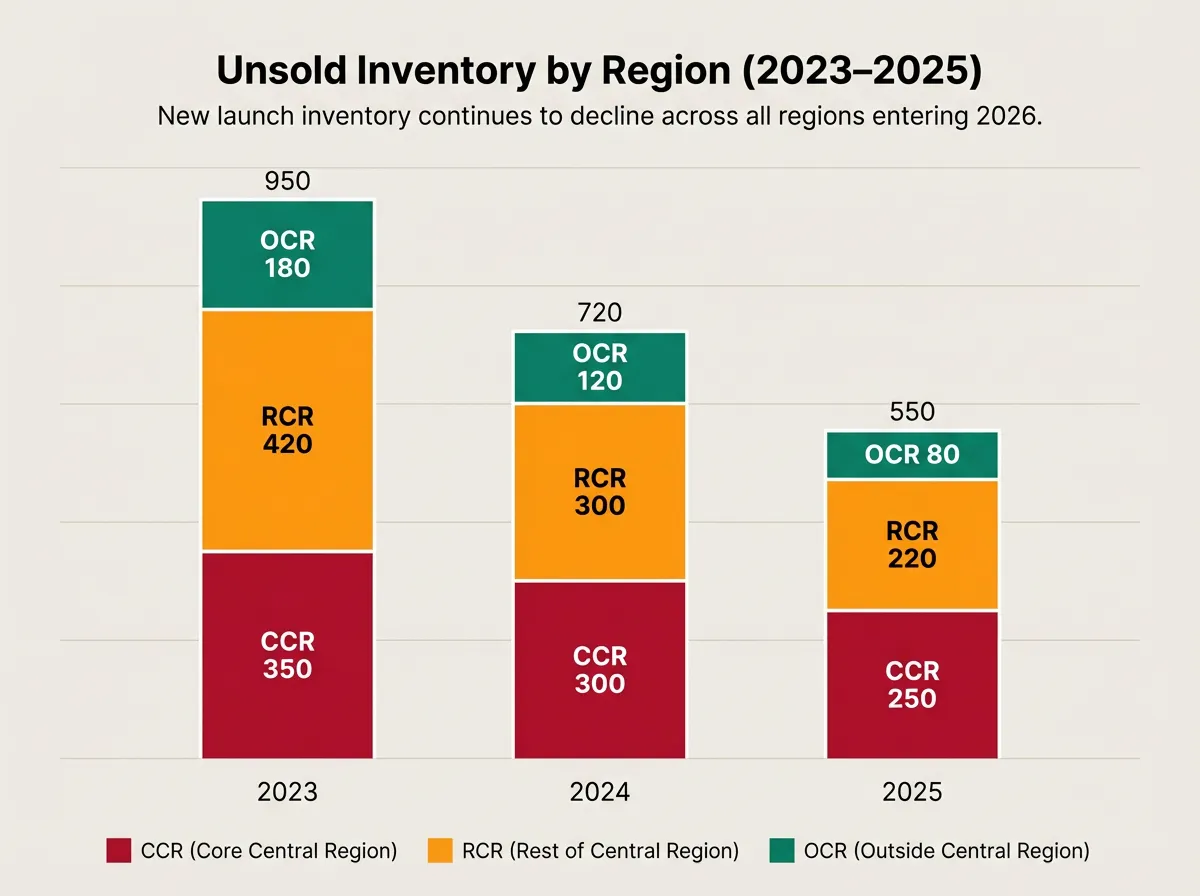

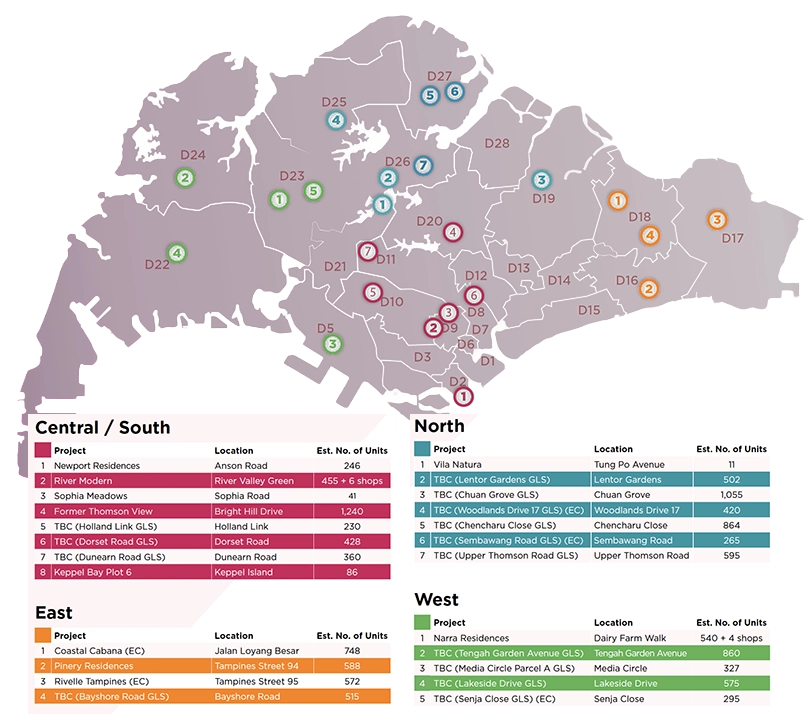

At the same time, unsold inventory is uneven. OCR is almost cleared out, RCR is tight but District 5 and the central fringe still carry meaningful stock, and CCR launches — while healthy — tend to sell gradually over a longer window. Against this backdrop, the 2026 new launch pipeline of around 11,818 units across 24 projects is coming into focus.

For readers who may be unfamiliar with how Singapore is divided by regions and districts, the Singapore districts and regions guide provides a clear overview of where the CCR, RCR and OCR regions are located and which districts fall under each.

This Mega Guide takes a data-backed look at 2026’s new launch market, building on 2025 performance, GLS tender results, unsold inventory, transformation zones and income trends. It also highlights the Top 10 projects to watch and what buyers can realistically expect in the year ahead.

Table of Contents

- What 2025 Taught Us About Buyer Behaviour

- Unsold Inventory Snapshot (Q4 2025)

- Why 2026 Is a Pivotal Year

- 2026 Pipeline Overview by Region

- Price Expectations for 2026

- Top 10 New Launch Projects to Watch

- Where We Are in the Property Cycle

- Key Risks and Unknowns

- How a Personal Strategy Matters More Than the Market

- Planning Your Next Move

- Frequently Asked Questions (FAQ)

What 2025 Taught Us About Buyer Behaviour

If 2022–2023 were years of price discovery after COVID, 2025 proved the market’s resilience. Prices reached new highs, but well-located projects in every region continued to achieve strong demand. Understanding this helps decode why some 2026 projects stand on firmer ground than others — and why certain locations will continue outperforming over the next 12–18 months.

OCR remained the performance anchor

Over the past five years, OCR has consistently been the strongest-performing region in both price growth and take-up. This is driven by:

- deep HDB upgrader demand

- new MRT lines such as TEL, CCL extensions and upcoming JRL

- family-friendly layouts and larger 3BR/4BR stacks

- price quantum that remains accessible despite higher psf

OCR buyers are value-sensitive but not necessarily “cheap-seeking”. They are willing to pay for convenience, schools and MRT access — especially when weighing new-launch uplift against resale alternatives and considering long-term affordability.

CCR projects sold well, but at a different rhythm

CCR demand remains healthy, but behaves very differently from OCR/RCR. The old pattern of “1-bedrooms sell first” no longer applies universally. In launches such as Upper House, Skye at Holland, River Green and several central branded residences, larger 3BR and 4BR formats led early sales.

These projects appeal to:

- affluent own-stay buyers prioritising space and location

- long-term wealth-preservation investors

- expatriate tenants who favour larger layouts

CCR launches still sold well, but typically over a longer window — with many projects gaining stronger traction closer to TOP. This rhythm is consistent with the patterns described in the property market cycle framework, where central projects tend to move in waves shaped by macro conditions and long-term supply dynamics.

This trend will apply directly to 2026’s launches, such as River Modern, Newport Residences, Dunearn Road GLS and Holland Link GLS.

RCR is tight in 2026, but not empty

RCR appears lean for 2026, but the picture is more nuanced. District 5 still has remaining stock in Terra Hill, Blossoms by the Park, The Hillshore, ELTA and LyndenWoods, plus investor stock in One-North rentals.

This affects how buyers will view Media Circle Parcel A GLS — a strong location for tenants, but entering a competitive micro-market.

Meanwhile, Thomson View benefits from the opposite dynamic: central-fringe scarcity, school-belt appeal and proximity to nature and MRT. Families planning ahead for primary school access, such as Ai Tong Primary School, will be evaluating condo options in this area.

Rates and real incomes improved affordability

Interest rates have retreated meaningfully from their 2023 highs, improving monthly instalments and stress-test buffers. At the same time, MAS reported real income growth recovering to 4.3% in 2025 amid low inflation.

This combination brought many buyers who had paused for 1–2 years back into the market, particularly families comparing resale vs new launch affordability.

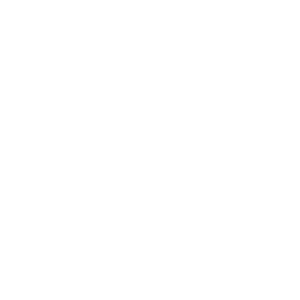

GLS tenders show high developer conviction

Recent GLS results reveal developer sentiment clearly:

- Dunearn Road GLS — $1,410 psf ppr (9 bids)

- Bayshore Road GLS — $1,388 psf ppr (8 bids)

- Lakeside Drive GLS — $1,132 psf ppr (6 bids)

- Chencharu Close GLS — $980 psf ppr (3 bids)

- Bedok Rise GLS — $1,330 psf ppr (10 bids)

The 10 bids for Bedok Rise were especially noteworthy — a clear signal that developers are bullish about OCR upgrader demand heading into 2026.

Unsold Inventory Snapshot (as of Q4 2025)

Unsold inventory influences how aggressively developers price new launches, how quickly they adjust prices after launch, and how sensitive each region is to external shocks. The picture entering 2026 is clear:

| Region | Representative Projects | Approx. Unsold Units | What It Suggests |

|---|---|---|---|

| CCR |

Upper House, Skye at Holland, River Green, W Residences, One Sophia, Robertson Opus, Aurea |

~250 units | CCR stock remains available but moves more steadily. Buyers choose carefully, often committing closer to TOP. CCR launches work best as lifestyle or long-cycle holdings. |

| RCR |

Terra Hill, Blossoms by the Park, The Hillshore, ELTA, LyndenWoods, Grand Dunman |

~220 units | RCR remains tight, but District 5 still has stock. Media Circle must navigate this competitive backdrop; Thomson View benefits from strong central-fringe scarcity. |

| OCR | Various mature-area OCR launches (2022–2024) | ~80 units island-wide | OCR is nearly cleared, giving 2026’s many upgrader-focused launches a clean runway. |

Why 2026 Is a Pivotal Year

The 2026 new launch pipeline is not just large — it is strategically important. Supply is uneven, buyer confidence is improving, income growth has strengthened, and several transformation zones are entering visible execution. These factors set the foundation for a year that could shape Singapore’s property landscape for the next decade.

Supply is large but uneven

The 24 planned launches (11,818 units) are spread across OCR, RCR and CCR — but not evenly:

- OCR (≈ 71%) — the main engine of demand, driven by HDB upgraders.

- RCR (≈ 18%) — limited supply, but still some competition in D5.

- CCR (≈ 11%) — selective launches with long-cycle demand.

For readers newer to the private-property landscape, CCR, RCR and OCR each play a different role in shaping demand. OCR remains the most active because of upgrader-driven demand, while RCR and CCR behave more selectively depending on location, tenure and price sensitivity.

Affordability and real incomes improved

Affordability in 2026 is stronger than it was in 2023–2024. Two major shifts occurred:

- Interest rates fell from their peak, reducing monthly instalments.

- Real income growth recovered to about 4.3% as inflation eased.

This means buyers entering 2026 — especially upgraders — are operating with better overall financial confidence, even if prices remain high.

Transformation zones are entering a visible phase

2026 is the first year where several long-discussed transformation areas begin taking visible shape. These zones are critical because they influence long-term price growth and buyer demand.

Tengah — Singapore’s first forest town expands into private market

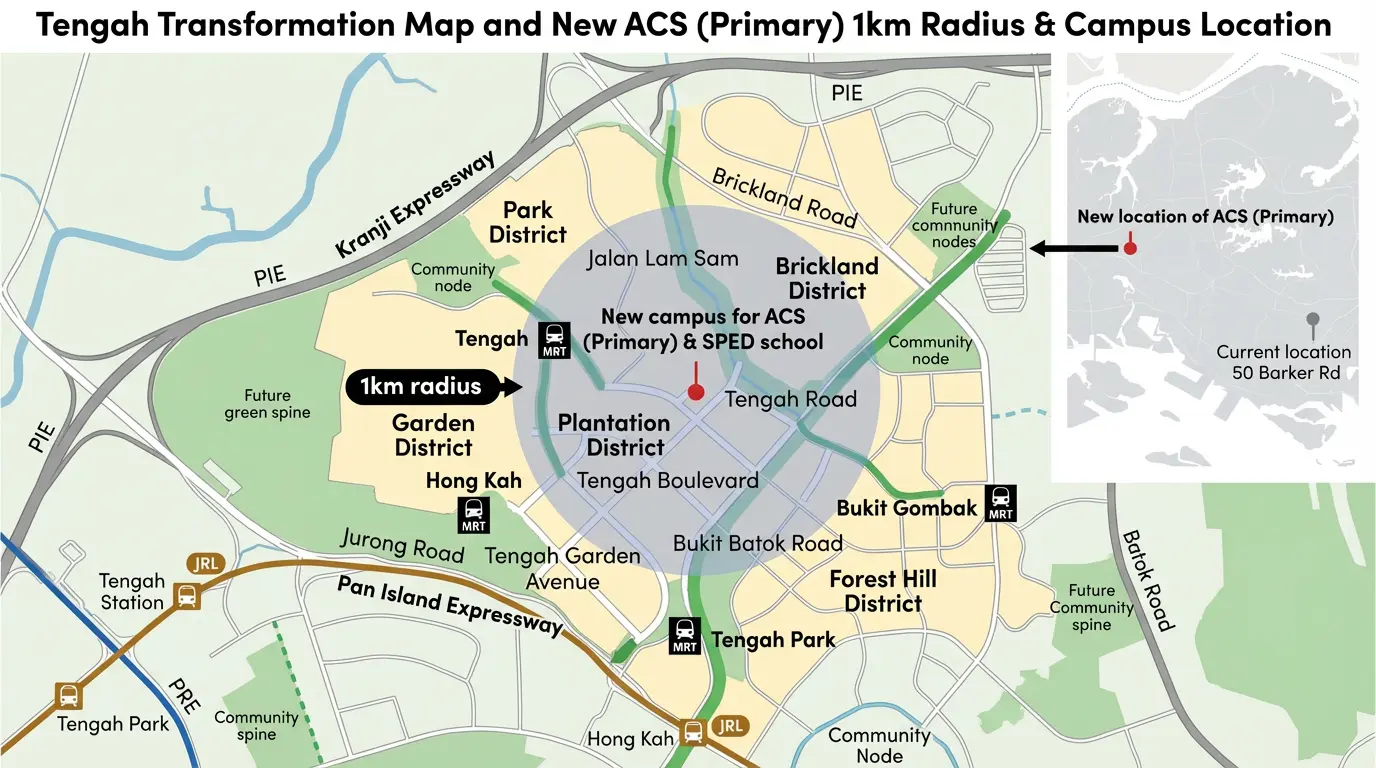

Tengah has been developing steadily over the last few years, but 2026 marks the first major step into private housing with the launch of Tengah Garden Avenue GLS. This launch sits at the heart of a transformation powered by:

- the upcoming Jurong Region Line (JRL)

- new MRT nodes such as Hong Kah and Tengah Plantation

- a car-lite, sustainability-focused master plan

- close proximity to Jurong Lake District

- ACS (Primary) relocating to Tengah in 2030

This last point is extremely significant. Historically, the presence of top primary schools has shaped price growth in Bukit Timah, Queenstown and Marine Parade. Tengah could follow a similar trajectory, as families plan ahead for the ACS relocation.

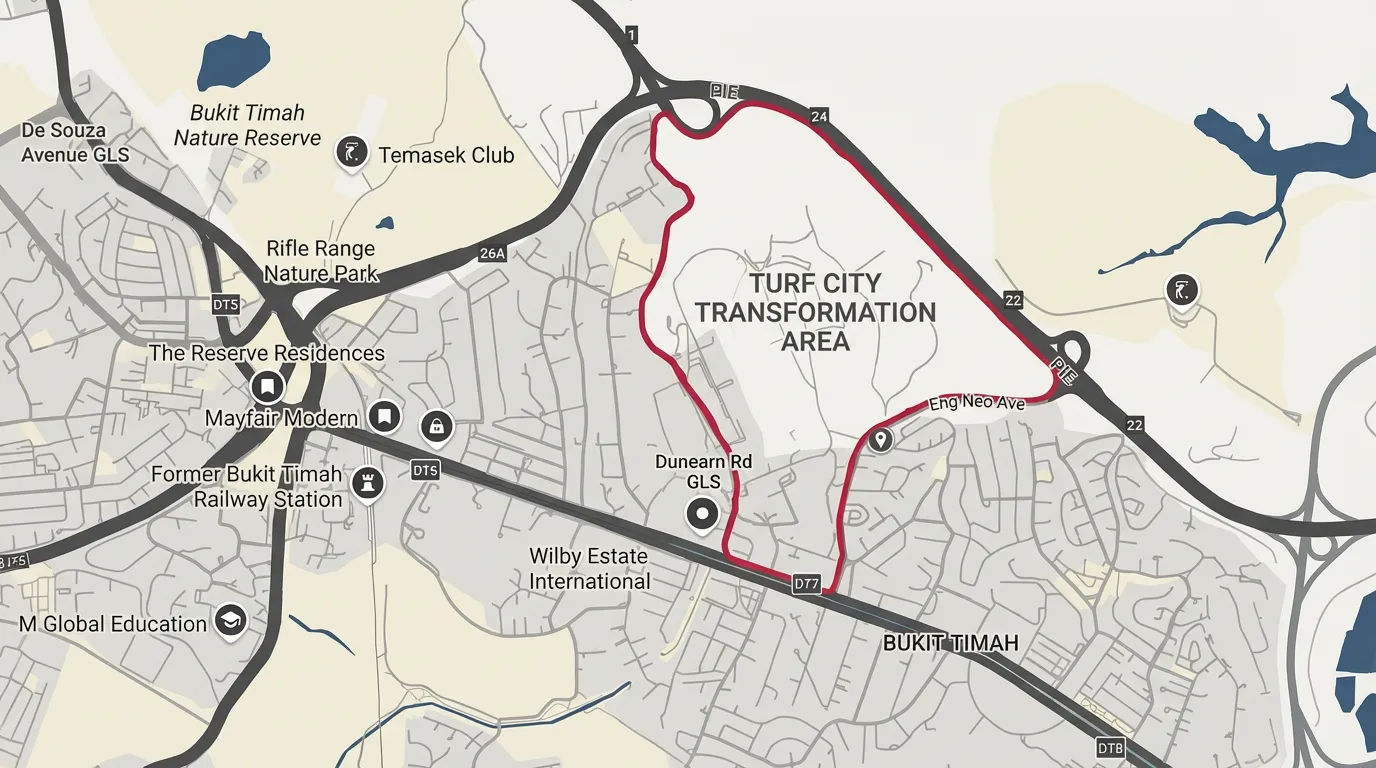

Bukit Timah / Dunearn Road / Turf City — a once-in-a-generation redevelopment

The Turf City transformation is one of Singapore’s most significant redevelopment stories. It will reshape the surrounding Bukit Timah–Dunearn Road corridor — an area already known for its prestigious schools and low-density living.

Located in this zone, Dunearn Road GLS is positioned to benefit from:

- school-belt demand (SCGS, ACS, Nanyang Primary nearby)

- limited new supply in Bukit Timah over the last decade

- the uplift from Turf City’s redevelopment

The Bukit Timah belt consistently attracts families prioritising proximity to well-known schools. As highlighted in the Ai Tong School and Bright Hill MRT condo guide, parents planning for primary school access often make decisions years ahead. Dunearn Road GLS is well positioned to benefit from similar long-term planning behaviour.

Bayshore — the East Coast’s new integrated waterfront node

Bayshore is evolving into a fully integrated waterfront district. With two TEL stations — Bayshore and Bedok South — and a master plan connecting homes directly to East Coast Park, this zone is expected to anchor the next phase of East-side OCR demand.

The Bayshore Road GLS carries one of the highest OCR land costs ever tendered at around $1,388 psf ppr. High land cost introduces price sensitivity, but it also signals developer conviction in the long-term East Coast story.

Much like how the Lentor cluster formed a new identity in 2022–2024, Bayshore could become the defining OCR cluster of the next decade.

Developers are confident — but selective

Unlike 2017–2018, when developers aggressively accumulated en bloc sites, 2024–2025 developers bid selectively. Strong bids concentrated in specific zones:

- Dunearn Road GLS — school belt + transformation uplift

- Bayshore Road GLS — East Coast waterfront district

- Lakeside Drive GLS — JLD adjacency

- Lentor Gardens GLS — continued cluster identity

- Chuan Grove GLS — mature D19 upgrader base

The message is clear: developers are bullish, but only in locations with long-term planning support, transformation uplift or proven school-belt demand.

2026 Pipeline Overview by Region

The 2026 pipeline features 24 launches and 11,818 units, but the distribution across OCR, RCR and CCR matters far more than the total number. Each region has a different demand base, different supply story and different long-term outlook. Understanding these differences helps buyers avoid overpaying in the wrong micro-market — and spot scarcity opportunities early.

Below is a detailed breakdown of how each region will shape buyer behaviour in 2026.

OCR — The Core Engine of 2026

OCR will define the overall sentiment of the 2026 new launch market. With nearly three-quarters of all new units, OCR launches will determine pricing benchmarks, quantum expectations and early-year momentum.

Key OCR launches include:

- Tengah Garden Avenue GLS — the first private condo in Tengah, next to future Hong Kah MRT, and the earliest beneficiary of ACS (Primary)’s 2030 relocation.

- Bayshore Road GLS — a high-stakes, high-land-cost East Coast node anchored by TEL connectivity and waterfront access.

- Pinery Residences — riding on Tampines’ huge upgrader base, strong transport links and decades of proven resale demand.

- Chuan Grove GLS — located in a mature D19 belt supported by family demand and established amenities.

- Lentor Gardens GLS — the next phase of the Lentor masterplan, building on the established Lentor identity formed between 2022–2024.

- Coastal Cabana EC — a rare seafront executive condo in Pasir Ris, previewing 6–21 December 2025 and booking on 17 January 2026.

What this means for buyers: OCR price growth will likely continue into 2026, but more evenly. MRT adjacency, transformation uplift and quantum discipline will separate the winners from the merely “okay” launches.

RCR — Selective but High-Impact

RCR supply is thin for 2026, but the two major launches carry enormous significance because they target different buyer profiles entirely.

- Thomson View — the central-fringe RCR heavyweight. Near-CCR in appeal, with Upper Thomson MRT, nature corridor frontage and a highly strategic position for Ai Tong families.

- Media Circle Parcel A GLS — the one-north investor magnet with immediate access to Fusionopolis, Biopolis and tech-sector tenant pools.

But… RCR is not empty. District 5 still holds unsold stock from:

This means Media Circle A must compete intelligently — especially for investor dollars — while Thomson View faces virtually no central-fringe competition.

CCR — Premium, Selective and Long-Cycle

CCR has the smallest 2026 pipeline, but arguably the highest strategic value. This year’s launches are not “mass-market CCR” — they are targeted, differentiated and designed for affluent buyers with longer horizons.

- River Modern — integrated with Great World MRT, river frontage, mall access and a historically strong rental base.

- Newport Residences — a rare freehold CBD-fringe launch with high rentability and limited competition in its micro-market.

- Dunearn Road GLS — benefiting from Bukit Timah’s school belt and the powerful uplift of the Turf City redevelopment.

- Holland Link GLS — a niche D10 launch in a low-density lifestyle enclave.

- Keppel Bay Plot 6 — the evolution of waterfront CCR-fringe living with strong tenant appeal.

The CCR buyer of 2026 is not rushed. They prioritise tenure, location and long-term capital preservation. CCR projects tend to move in longer, steadier buying cycles, with demand building gradually rather than concentrating on launch weekend.

Price Expectations for 2026

2026 pricing will be shaped by land cost, construction materials, interest rates and competitive micro-markets. Based on recent GLS tenders and 2025 benchmarks, realistic expectation bands are:

- OCR (Private): $2,000 – $2,400 psf

- Premium OCR: $2,700 – $3,000 psf

(e.g., Thomson View, Bayshore Road GLS) - Executive Condos: from ~$1,639 psf

(e.g., Coastal Cabana EC) - RCR: $2,300 – $2,600 psf

- CCR: $2,700 – $3,800 psf

(higher for freehold and premium stacks such as Newport Residences)

These price levels reflect today’s market fundamentals — including higher GLS land rates, construction costs and the exceptionally low supply of OCR units entering 2026. Developers are operating within a tighter cost structure, which sets firmer price floors across most segments.

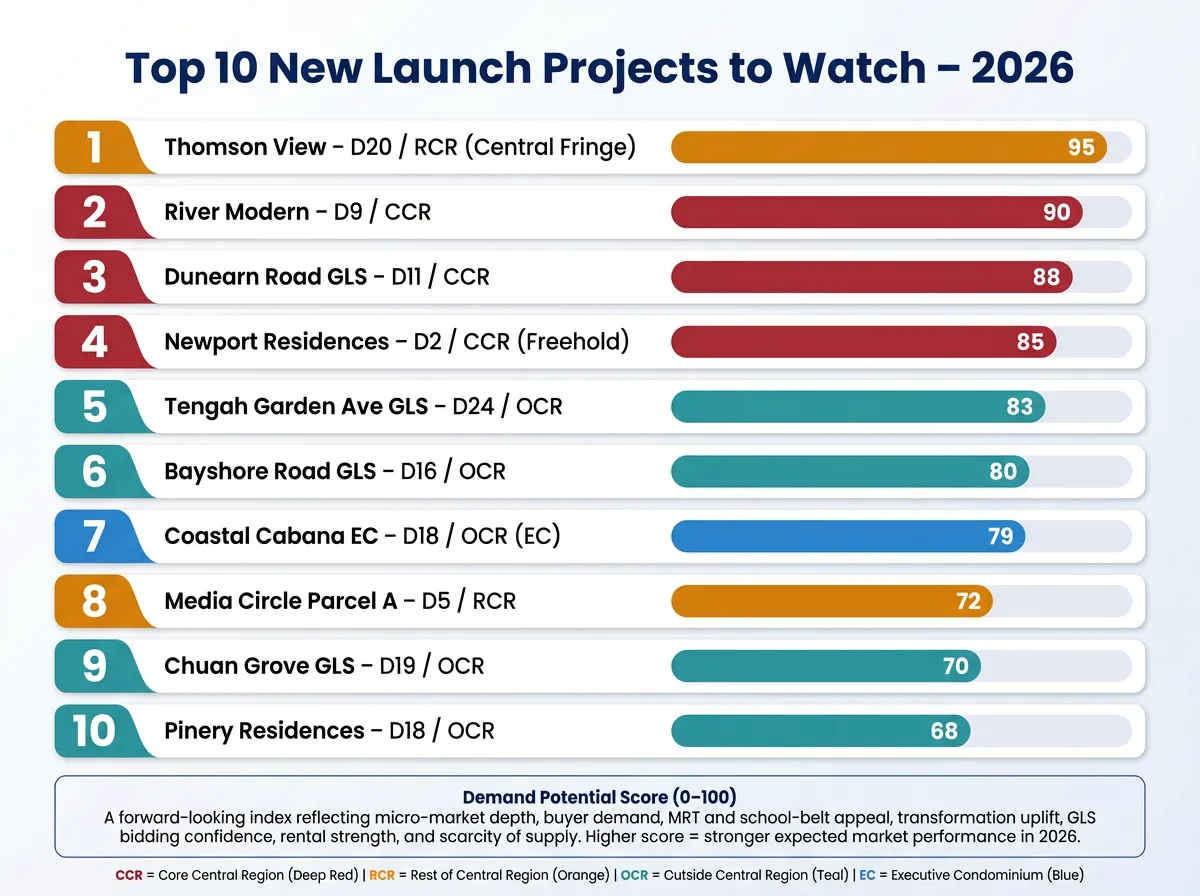

Top 10 New Launch Projects to Watch in 2026

Below is a fully reasoned breakdown of the Top 10 shortlist, highlighting the projects expected to shape buyer interest in 2026. Project links are provided in the descriptions for readers who want deeper details on each development.

- Thomson View – RCR (Central Fringe)

- River Modern – D9 / CCR

- Dunearn Road GLS – D11 / CCR

- Newport Residences – D2 / CCR (Freehold)

- Tengah Garden Avenue GLS – D24 / OCR

- Bayshore Road GLS – D16 / OCR

- Coastal Cabana EC – D18 / OCR (EC)

- Media Circle Parcel A GLS – D5 / RCR

- Chuan Grove GLS – D19 / OCR

- Pinery Residences – D18 / OCR

Why Thomson View ranks #1: It combines multiple long-term demand pillars rarely found in a single project — central-fringe location, strong school-belt appeal, MRT access, nature proximity and genuine scarcity of new supply in the area. Its scale and positioning place it at the centre of upgrader demand for 2026.

Where We Are in the Property Cycle

To understand where 2026 sits in Singapore’s property cycle, it helps to look at demand behaviour in 2025, GLS bidding trends and broader economic data. Multiple indicators now point to an early expansion phase — a period where confidence improves gradually, price growth stabilises, and buyers become more decisive.

The property market cycles guide outlines how Singapore’s real estate market typically moves through phases of hesitation, recovery, expansion and consolidation. Based on current demand, affordability and GLS behaviour, 2026 aligns most closely with the early expansion phase.

Key supporting signals:

- Interest rates have eased from their peak, bringing down monthly instalments and stress-test burdens.

- Real income growth improved to 4.3% in 2025, giving households stronger purchasing power.

- OCR stock is at one of the lowest points in the past decade, creating natural upward pressure for well-located projects.

- GLS tenders are competitive — with multiple sites receiving 6–10 bids, signalling developer confidence.

- Transformation zones (Tengah, Bayshore, Turf City, Lentor) are crossing into visible execution phases.

This does not imply a runaway bull market. Instead, 2026 is likely to deliver targeted strength: projects with strong fundamentals will perform well, while weaker projects may struggle against better alternatives.

Key Risks and Unknowns

Even in a constructive environment, it is important to recognise risks that may shape buying behaviour and launch performance throughout the year.

Global macro and geopolitical shocks

A sharp recession, geopolitical escalation or financial sector stress could temporarily dampen sentiment, especially for higher-psf CCR launches.

Overpricing in select OCR sites

High land costs at certain GLS plots mean developers will push pricing boundaries. If those prices exceed upgrader comfort levels, demand may slow despite good fundamentals.

Policy changes

If prices rise too rapidly, targeted cooling measures are possible — particularly toward investment-heavy districts.

CCR’s longer absorption cycle

CCR launches typically sell steadily but slowly. Projects such as W Residences and Robertson Opus show how momentum increases closer to TOP, rather than during launch weekend.

Localized competition

Districts with overlapping supply — such as D5 — require sharper differentiation in layout, price and positioning. Meanwhile, central-fringe locations like Thomson View benefit from scarcity.

How a Personal Strategy Matters More Than the Market

Market-wide outlooks are useful for understanding big-picture trends, but real estate decisions are always personal. Your financial profile, timeline, family needs and long-term plans matter far more than whether “the market is hot” or “prices are rising.”

Key strategic considerations include:

- your loan profile, interest-rate sensitivity and long-term holding power

- whether you intend to prioritise schools (e.g., Ai Tong, ACS, SCGS)

- whether lifestyle or convenience matters for daily routine

- your tolerance for renovation, rental management or vacancy risk

- whether rental yield, capital appreciation or both are important

The property cycles guide shows that buyers who align their decisions with their financial horizon and holding power often achieve better long-term outcomes than those trying to time short-term price movements.

In 2026, the central strategic question isn’t “Is this the right time?”

It’s: “Which move positions my family or portfolio best over the next 5–10 years?”

Planning Your Next Move

If you’re considering a purchase in 2026 — whether upgrading from HDB, buying for your family, or investing in transformation zones — having a personalised plan makes all the difference.

I help buyers and investors:

- Compare new launch vs resale options based on data, not emotion

- Analyse affordability with personalised loan simulations and cashflow mapping

- Evaluate schools, tenant pools and transformation zones

- Identify strong stacks and avoid common layout mistakes

- Build a long-term property roadmap across multiple purchases

If you’d like a tailored 2026 game plan based on your numbers, goals and timeline, feel free to reach out for a one-to-one consultation.

I’ll review your financials, shortlist suitable projects, and map out a strategy that fits your family — not just the headlines.

Frequently Asked Questions (FAQ)

1. Is 2026 a good time to buy?

For many genuine buyers, yes — especially those upgrading from HDB or those entering transformation zones. Improved affordability and strong OCR fundamentals support stable demand.

2. Should I focus on OCR, RCR or CCR?

OCR remains the most active region, RCR is selective and competitive, and CCR suits long-hold buyers prioritising stability and prestige.

3. Are ECs worth considering?

Executive condos offer strong value for eligible upgraders — particularly rare options like Coastal Cabana EC. But MOP rules mean they don’t fit every timeline.

4. Will prices fall?

Broad-based price declines are unlikely due to high GLS costs, low OCR stock and improving income fundamentals.

5. What about ACS moving to Tengah?

ACS (Primary)’s relocation in 2030 will likely boost demand within the 1–2 km radius over time — similar to the uplift seen in established school belts like Bukit Timah and Bishan.