On Dec 15th, 2021 The Singapore Government announced a package of measures to cool the private residential and HDB resale markets. With effect from 16 December 2021, Additional Buyer’s Stamp Duty (ABSD) rates will be raised, and the Total Debt Servicing Ratio (TDSR) threshold will be tightened. The Government has also tightened the LTV limit for loans from HDB from 90% to 85%

Update: (16-March-2023)

During Budget 2023, the Government announced that BSD rates for both residential and non-residential properties will be raised with effect from 15 Feb 2023.

Update: (26-April-2023)

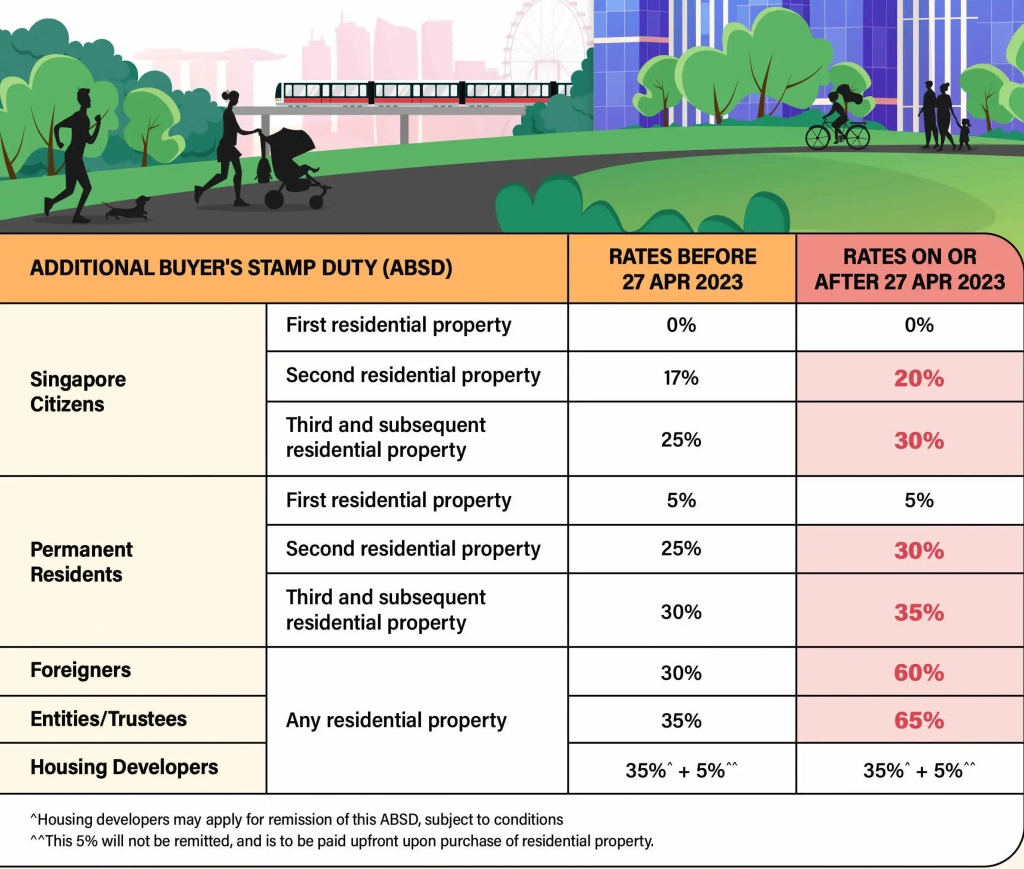

On 26 Apr 2023, the Government announced that ABSD rates will be raised with effect from 27 Apr 2023, to promote a sustainable property market. There is a transitional ABSD remission for residential properties acquired on or after 27 Apr 2023, subject to the remission conditions being met.

What is Buyer’s Stamp Duty (BSD)?

As long as you are buying property located in Singapore, you will need to pay BSD. The amount of Buyer Stamp Duty you will need to pay is computed based on the purchase price of the property or the market value of the property (whichever is higher).

Before 20 February 2018, the maximum percentage of BSD you will have to pay on all properties was up to 3%.

Since then two main changes were implemented:

- There are now differentiated BSD rates on residential and non-residential properties (here is how to differentiate between them).

- The BSD rate for residential properties went up; the maximum percentage of BSD you will have to pay on residential properties is now up to 6%.

How Much Buyer’s Stamp Duty Do I Need to Pay?

| Purchase Price or Market Value of the Property | BSD Rates for Residential Properties | BSD Rates for Non-Residential Properties |

|---|---|---|

| First $180,000 | 1% | 1% |

| Next $180,000 | 2% | 2% |

| Next $640,000 | 3% | 3% |

| Next $500,000 | 4% | 4% |

| Next $1,500,000 | 5% | 5% |

| Amount exceeding $3M | 6% |

*BSD is rounded down to the nearest dollar, subject to a minimum duty of $1.

Buying a property above certain thresholds ($180k, $360k, $1 million) means you will have to pay much more in BSD.

Let’s say you were to purchase a property that costs $1.5 million at market value:

| Market Value of the Property | BSD Rate | Calculation |

|---|---|---|

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $19,200 (3% x $640,000) |

| Remaining Amount | 4% | = $20,000 (4% x $500,000) |

| BSD Payable (rounded down to the nearest dollar) | = $44,600 ($1,800 + $3,600 + $19,200 + $20,000) |

Compared to a property that costs $500,000:

| Market Value of the Property | BSD Rate | Calculation |

|---|---|---|

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $4,200 (3% x $140,000) |

| BSD Payable (rounded down to the nearest dollar) | = $9,600 ($1,800 + $3,600 + $4,200) |

As evident above, you should expect to pay exponentially more in BSD for an expensive property.

Buyer Stamp Duty Calculator

Before making a property purchase, you can use the Stamp Duty Calculator from the Inland Revenue Authority of Singapore (IRAS) website to calculate the exact amount of BSD you’ll need to pay.

What is Additional Buyer’s Stamp Duty?

You’ll need to pay Additional Buyer’s Stamp Duty (ABSD) on top of BSD if you’re a(n):

- Singapore Citizen (SC) making a second residential property purchase or subsequent property purchases

- Singapore Permanent Resident (SPR) making your first property purchase

- Foreigners making any property purchase

- An Entity at an almost uniform rate

This is basically an add-on to BSD that is tagged to all purchases of residential properties in Singapore.

Why is there a need for ABSD?

It’s basically a means to cool property prices as it discourages demand driven by high-SES Singapore citizens, foreigners, and entities who were buying up multiple properties.

And engaging in property speculation.

That’s not great for people who are actually looking for a place to stay.

In particular, it helps to keep residential properties affordable.

Especially for Singapore Citizens looking to buy their first residential property.

What Types of Properties are Considered a Residential Property Under ABSD?

HDB

- HDB Flats

- HDB void deck shops with residential floor

- Executive Condominiums (EC)

Private Property

- Condominiums

- Bungalows

- Terrace Houses

- Shophouses with living quarters

How Much Additional Buyer’s Stamp Duty Do I Need to Pay?

The amount of ABSD you will need to pay is based on your residency status and nationality at the point of making the property purchase.

This is reflected in the date of issue reflected on the IC collection slip.

It is also dependent on whether the buyer is an individual or entity.

Entities are defined as the following:

- An unincorporated association

- A trustee for a collective investment scheme when acting in that capacity

- A trustee-manager for a business trust when acting in that capacity

- The partners of the partnership whether or not any of them is an individual, where the property conveyed, transferred or assigned is to be held as partnership property

*As entities, developers will also be subject to the ABSD rate of 35%. Developers may apply for remission of this 35% ABSD, subject to approval.

The ABSD percentages shown below will be applicable to the property’s market value or purchase price (whichever is higher).

Another thing to note is that so long as a buyer owns any interest in a property, that property will be included in the number of properties owned.

Let’s say a person was to jointly own residential property with their partner and own a 30% share of another property with his/her sibling.

IRAS considers that as the person owning two properties.

ABSD is rounded down to the nearest dollar, subject to a minimum duty of $1.

ABSD for Those Buying Multiple Properties

Although many properties may be bought under a single contract, each property will be counted as separate property. You may choose any one of the multiple properties to be subject to ABSD.

ABSD for Property Bought With Someone Else

If a property is bought jointly bought by people of different profiles, the profile with the highest ABSD rate will be used.

For example, let’s say you wanted to buy a property with your partner. Your partner owns a property but you do not.

Thus the amount of ABSD you need to pay is the ABSD rate on the purchase of second property at 20%

ABSD for Property Bought for Beneficial Owner

If you (A) are buying a residential property to be held in trust for the beneficial owner (B), the ABSD rate will be charged based on the profile of the beneficial owner (B).

For example, If the beneficial owner (B) owns no residential property, no ABSD is payable.

ABSD (Trust)

From 9 May 2022, an ABSD of 35% will apply on any transfer of residential property into a living trust i.e. a trust that is created by a person during his or her lifetime.

The ABSD (Trust) is to be payable upfront and will apply for any conveyance, assignment, or transfer on sale of residential property into a living trust irrespective of whether there are identifiable beneficial owners of the property.

Update: Trustee increase to 65% in the 27 April 2023 ABSD revision

Additional Buyer Stamp Duty Calculator

Before making a property purchase, you can also use the Stamp Duty Calculator from the IRAS website to calculate the exact amount of ABSD you’ll need to pay.

Is It Possible to Not Pay the Additional Buyer’s Stamp Duty?

There are a few situations where you will not need to pay ABSD.

When you are already contracted to sell your current residential property before you sign the Option to Purchase your new one.

IRAS considers that you only have ownership of only one residential property, so you’re exempted.

OR.

When you are selling your private property and buying an HDB resale flat.

You are also exempted from ABSD.

ABSD Remission For Married Couples

In general, foreigners and Permanent Residents are required to pay ABSD.

However, if you are married to a Singaporean and you do not own any residential property, you are not required to pay ABSD.

In addition, you can get a refund on your ABSD if you’re moving to another house as a married couple.

To obtain the refund, the property that you paid ABSD for needs to be sold within six months of purchasing the next property.

ABSD (Trust) Remission

A trustee may apply to the IRAS for the remission of ABSD (Trust) via a refund, where the conveyance, assignment or transfer on sale of residential property to a person i.e. trustee, is held on trust for one or more identifiable individual beneficiaries only.

The amount remitted will be based on the difference between the ABSD (Trust) rate of 65% and ABSD rate corresponding to the profile of the beneficial owner with the highest applicable ABSD rate.

Moreover, the application for the refund must be made within six months after the date of execution of the instrument.