Estimated reading time: 7 minutes

Property asset progression in Singapore is no longer just a buzzword for investors. It is a practical roadmap for everyday owners who want to live better today while building wealth for tomorrow. The concept of Property Asset Progression: Smart Upgrading for Owners, involves having the right plan, so moving from your first HDB or condo into a more suitable home does not have to be stressful or risky.

In this guide, I’ll show you how a structured upgrade actually works, using a realistic case study of a young couple upgrading from HDB to a private condo, and the same thinking you can apply to your own situation.

Property Asset Progression Singapore: What It Really Means

At its core, property asset progression is simply about using each move to improve both your lifestyle and your long-term financial position. It is not about chasing every “hot” launch. It is about understanding your numbers, your goals, and how today’s property choice sets up your next one.

A clear property asset progression framework helps owners choose the right path at different life stages.

Case Study: From “First Home” to “Next Stage”

Our couple is in their early thirties, both working full-time in stable roles. A few years ago, they bought a four-room HDB flat in a mature estate. Over time, resale prices in their block increased, and their outstanding loan balance slowly decreased.

As they started planning for children, their priorities shifted. They wanted:

- More privacy

- Facilities like a pool, gym, and playground

- Better long-term capital growth than staying in the same HDB

They had heard of property asset progression and seen friends upgrade, but doing it themselves felt confusing. What if they mis-timed the market or over-stretched their finances? These are the same questions many upgraders quietly have.

The Real Pain Points Owners Face When Upgrading

When we sat down to map out their journey, four familiar worries appeared.

1. Sell first or buy first?

Selling first felt safer, but they worried about being “homeless” for a while or needing to rent. Buying first seemed more comfortable, but they did not like the idea of juggling two large loans at the same time.

2. How much can they really afford?

They knew rules such as TDSR, MSR and LTV rules were there to prevent over-borrowing, but online calculators gave different answers. TDSR, MSR, and LTV rules matter even more when you already have a car loan or other liabilities.

3. What if interest rates move again?

Headlines about changing mortgage rates had made them nervous. They wanted an upgrade that still felt comfortable even if rates are adjusted in the next few years, not just in the first year.

4. New launch or resale condo?

Friends were balloting for new launches. At the same time, the resale condo market in 2025 showed buyers becoming more selective and value-driven. They were unsure which path best suited their timeline, risk appetite, and budget.

They did not need more opinions. They needed a clear, personalised roadmap.

Step 1: Get the Numbers Right Before Viewing Anything

Before stepping into any showflat or condo lobby, we did a full financial check-up. This included:

- The estimated market value of their existing HDB

- Outstanding loan and any early repayment conditions

- CPF used plus accrued interest

- Available CPF and cash for the next purchase

- Existing liabilities (car loan, credit lines, etc.)

- Combined monthly income and typical bonuses

From there, we calculated the expected selling price range, net proceeds after loan redemption and CPF refunds, and a comfortable (not maximum) loan quantum for the next home.

Step 2: Decide Whether to Sell First or Buy First

With the numbers in place, we tested both scenarios.

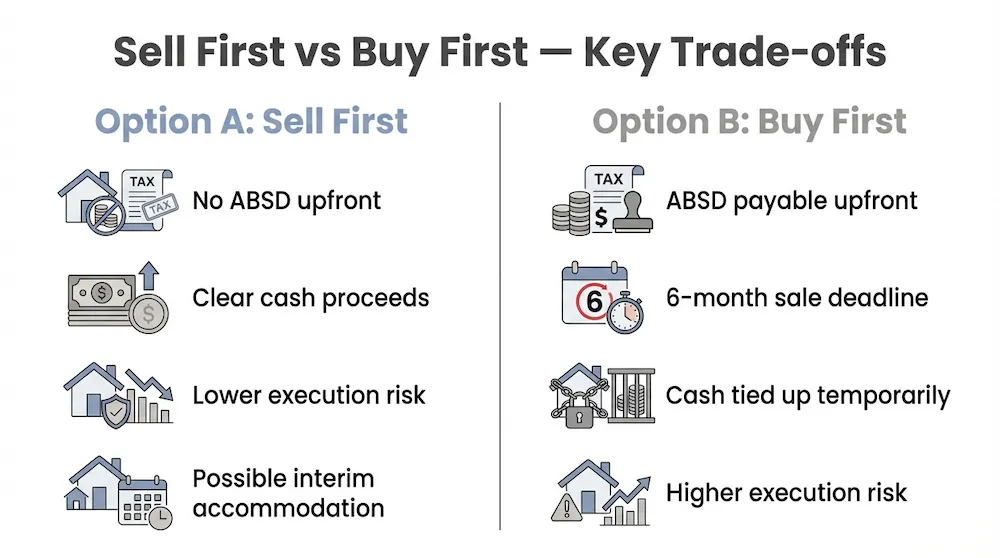

Option A: Sell first, then buy

Pros:

- No overlap of two mortgages, so the monthly cash flow stays predictable

- Clear view of actual sale proceeds and CPF refund timing before committing

- Lower execution risk (you’re not forced to sell under a deadline)

- Avoids triggering ABSD on a “second property” purchase in most owner-occupier cases

Cons:

- Risk of needing interim accommodation if timelines don’t align

- Pressure to find a suitable next home within your preferred window

- If you sell into a stronger market, you may buy into a stronger market too

Option B: Buy first, then sell

Pros:

- More time to shortlist and negotiate without rushing into a compromise unit

- Higher chance of one clean move if completion dates align

- Better flexibility if your family timeline is fixed (school, childcare, work changes)

Cons:

- Requires a stronger borrowing capacity and higher cash buffers to manage overlap

- Higher risk if the existing home takes longer to sell than expected

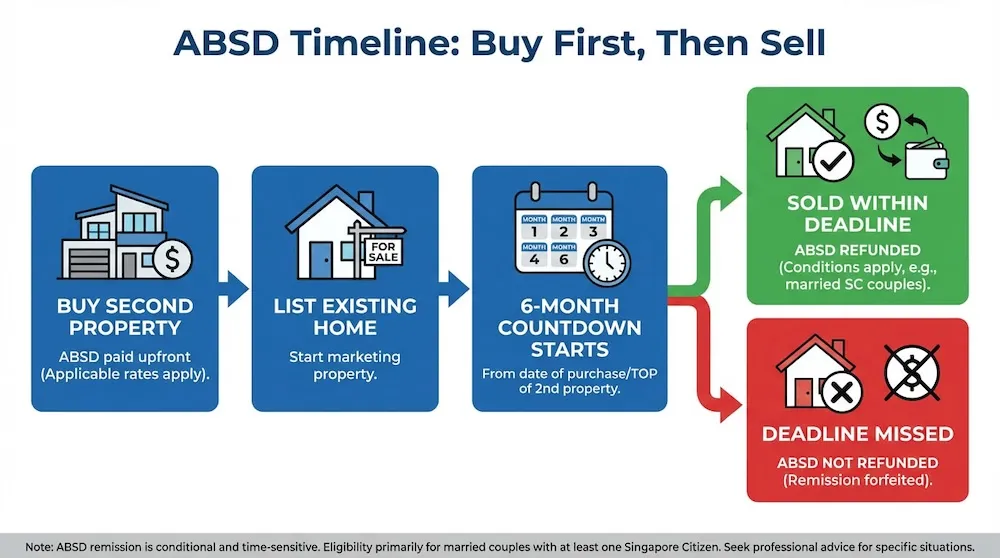

- ABSD is payable upfront when you buy a second residential property before selling the first

- ABSD remission (if applicable) is conditional — typically requiring you to be legally married, buy the replacement home jointly, and sell the existing property within 6 months (from completion for resale purchases, or from TOP/CSC for new launches)

- ABSD must still be paid first; it is only refunded after the sale completes within the required timeline, and if the deadline is missed, the ABSD paid may not be refunded

- HDB owners face an additional rule: if you own an HDB flat and buy a private residential property before selling the flat, HDB requires the flat to be disposed of within 6 months (separate from ABSD considerations)

- This can create forced-selling pressure, where owners feel pushed to discount the existing home to meet the 6-month deadline

For this couple, the safer move was a “sell first with planned transition” approach. That meant preparing the HDB for sale early, pricing it realistically, and negotiating completion and extension of stay to overlap with the condo purchase. This reduced risk, avoided rushing, and helped them move smoothly from one home to another.

Step 3: Read the Market, Not Just the Headlines

We looked at price trends, transaction volumes, buyer profiles, and upcoming supply. This helped narrow a shortlist of condos with resilient demand and practical layouts.

Step 4: New Launch vs Resale – Which Fits You Better?

Choosing between a new launch vs resale condo becomes clearer once you compare move-in timing and monthly comfort.

For this couple, lifestyle, space, and certainty mattered more than showflat gloss. A well-located resale condo proved to be the clear fit.

Step 5: Structure Your Financing for Long-Term Comfort

The plan considered staying well below TDSR ceilings, a sensible fixed-versus-floating mix based on mortgage interest rate trends in Singapore, retaining emergency funds, and future childcare or income changes.

With in-principle approval secured, negotiations proceeded calmly and confidently.

The Result: An Upgrade That Feels “Just Right”

They purchased a spacious two-bedroom condo in a city-fringe estate with strong transport links and family-friendly facilities. Because timelines were carefully planned, their HDB sale was completed smoothly, with proceeds aligned, and no interim rental was needed.

Key Takeaways for Owners Considering Property Asset Progression

- Start planning early

- Let goals drive strategy

- Respect personal comfort levels

- Think in stages, not single moves

- Use structured guidance, not opinions

Conclusion: Upgrading Is Achievable With the Right Roadmap

Property asset progression in Singapore is not just for seasoned investors. With clear numbers, thoughtful timing, and a realistic understanding of your options, everyday owners can upgrade their homes while building long-term financial strength.

If you are considering whether to sell first, buy first, or upgrade at all, a personalised review can make a meaningful difference. Every situation is different — loan structure, cash flow, timelines, and risk tolerance all play a role.

If you would like a tailored assessment of your current property, your upgrading options, and the safest way to move forward, get in touch with me directly for a personalised property asset progression review. A clear plan up front often prevents costly mistakes later.

Frequently Asked Questions (FAQ)

1. Do I need a very high income for property asset progression in Singapore?

No. Many couples progress by planning early, keeping loans within comfortable limits, and timing their sale and purchase carefully.

2. Is it always better to buy first, then sell?

No. Each approach has trade-offs depending on your finances and timing.

3. Should I choose a new launch or resale condo?

Both can work. Consider your timeline, cash flow, and lifestyle priorities.

4. How do TDSR and LTV rules affect my plan?

They cap borrowing power and monthly repayments. Understanding them early helps avoid surprises.

5. When is the best time to upgrade?

When finances are organised, suitable homes are available within budget, and the move aligns with your goals.