Last Updated on December 26, 2025

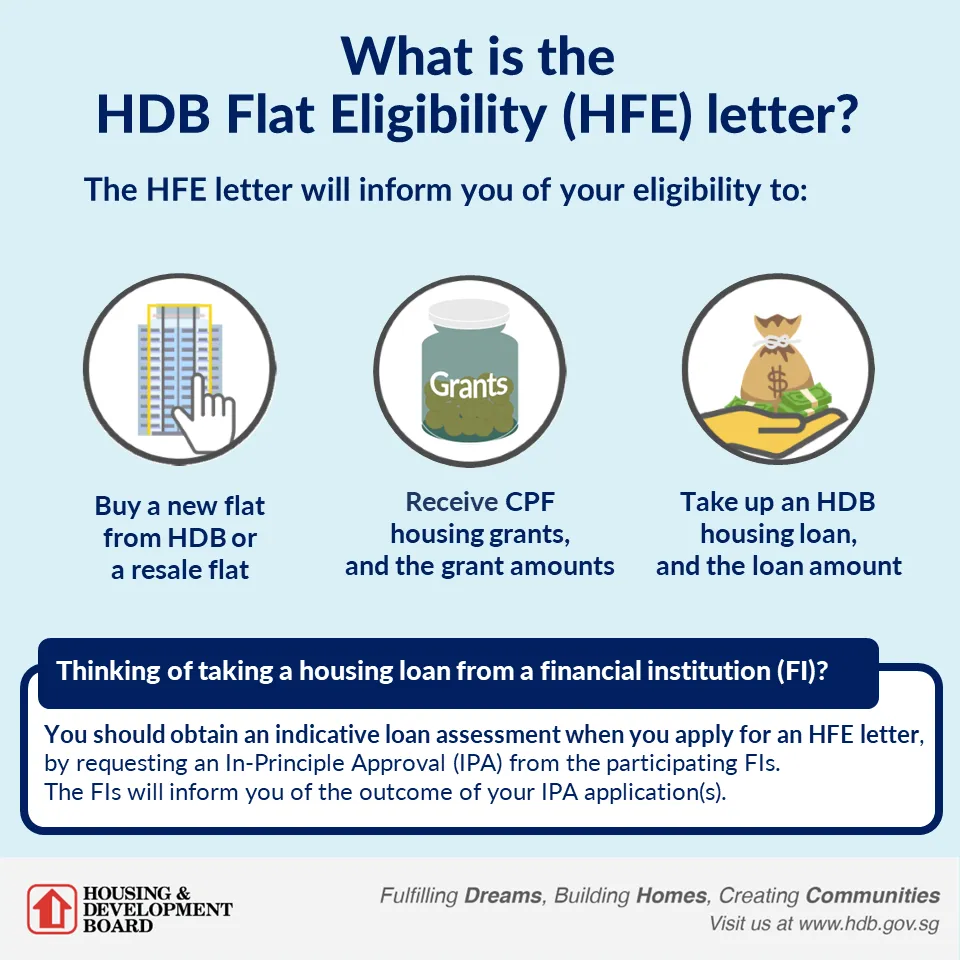

Thinking of buying an HDB flat soon? You will need an HDB Flat Eligibility (HFE) letter before you set off on your home-buying journey. HFE letter streamlines the flat buying process. With the HFE letter, you will know upfront your eligibility to:

- Buy a new BTO and/ or resale flat

- Receive CPF housing grants and the amount

- Take up an HDB housing loan, and the amount

Investing in Singapore property is a significant financial decision. Housing Development Board (HDB) flats are among the most common properties for Singapore Residents. This article will guide you through five steps to secure your HDB HFE letter, ensuring a smooth journey.

Understanding the HDB HFE Letter

Before diving into the steps, understand what an HDB HFE letter is. The HFE letter is issued by HDB and shows your eligibility to buy (new or resale), your CPF housing grant eligibility, and your indicative HDB loan outcome, including the maximum loan amount and tenure. Use HDB’s calculators or your bank’s in-principle approval to estimate monthly instalments and affordability. Without a valid HFE letter, buying an HDB property isn’t possible.

Step 1: Assess Your Eligibility

First, assess your eligibility for the HDB HFE letter. The HDB has specific criteria you must meet, including citizenship status, income ceiling, and previous loan history. If you currently own (or recently disposed of) a private residential property in Singapore or overseas, wait-out rules apply: typically 30 months before you can buy a subsidised flat (new BTO or a resale flat with CPF housing grants or an HDB loan) and 15 months for a non-subsidised resale flat. Certain senior exemptions apply. Review these rules carefully before proceeding.

Step 2: Prepare Necessary Documents

Once eligibility is confirmed, prepare the necessary documents. These include your NRIC, proof of income, and details of existing loans. If applying with a co-applicant, they must also provide their documents. Having these ready will speed up the application and increase your chances of securing the HDB HFE letter.

Step 3: Submit Your Application

With documents ready, submit your application for the HDB HFE letter online through the HDB website. You will see an instant preliminary outcome after you complete the initial questions (Step 1). Be sure to complete Step 2 — uploading documents and obtaining all co-applicant/occupier e-signatures — within 30 calendar days of starting Step 1, or you will have to restart from Step 1. After a complete Step 2 submission, HDB indicates processing can take up to about 21 working days; in practice, complete applications are often processed in roughly a week, though peak periods can be longer. Double-check your application before submitting to avoid errors that could delay the process. If you are planning for a BTO launch, aim to apply early and have all documents ready by the timeline HDB advises for each exercise.

Step 4: Review Your HFE Letter

When you receive your HDB HFE letter, review it carefully. Your letter confirms your buy eligibility (new/resale), CPF grant eligibility, and an indicative HDB loan outcome such as the maximum loan amount and tenure. Ensure these align with your financial plan. Use HDB’s calculators or a bank’s in-principle approval to estimate monthly instalments. Contact HDB for clarification or start a fresh application if you need to correct any details.

Step 5: Plan Your Property Investment

With the HDB HFE letter in hand, you can now plan your property investment. The letter gives a clear idea of your budget, allowing you to search for HDB flats within your price range. For resale purchases, a seller may only grant an Option to Purchase (OTP) if you have a valid HFE letter. If you are taking a bank loan, you will also need a bank Letter of Offer before exercising the OTP. Remember, investing in Singapore property is a long-term commitment. Choose a flat that meets both your current and future needs. Remember, the HFE letter is valid for 9 months from the date of issue.

Conclusion

Securing your HDB HFE letter is a critical step in your property investment journey. By following these five steps, you ensure a smooth and successful application process. The HDB HFE letter is more than just a document; it’s a tool that helps you plan finances and make informed decisions about your property investment. Take the time to understand it, prepare your documents, and plan wisely. With careful planning, your dream of owning an HDB flat in Singapore can become a reality.

For more information, contact me.